Best time to buy a stock ? Well what better than a recession when even the best in the business is available at a steep discount ! TCS is my 1st choice at the moment. Why ? Well, following points speak for itself (1) 2nd Largest IT company in the world with no worry of future business. (2) Largest company of Tata Group which is the largest business group of India. App. 70 % of profit of Tata group come from this single company. (3) Continuously growing top line and bottom line of business (4) Available at reasonable valuation with PE multiple of 29 (5) Regular buy back ensures value addition for share holders (6) Major company in both Sensex & Nifty and hence bought by both Indian as well as Overseas investor. When FII will come back, they buy blue chip shares like TCS first. (7) Operational for more than 5 decades now with consistent performance track ...

High Dividend Paying Stocks in India - IOC

- लिंक पाएं

- X

- ईमेल

- दूसरे ऐप

Indian Oil corporation Limited or IOCL or IOC is the largest fuel retailer of India as we all know with very well established Fuel, Gas & Lubricants distribution network in place. Fuel & Gas in perticular are businesses with very few players in place with very limited competition.

With lot of focus on environmental friendly non fosil fuel now a days, Oil still is the largest supplier of enery and will remains so for at least 2-3 decades. Contribution of non fosil fuel will increase gradually but hunger for energy will also double-triple very soon. So IOC has a Strong Moat which was refered by Great Mr. Warren Buffet. It also has creditial management,Indian Goverment itself being the largest shareholder. so, is IOC a good bet ??? Yes It is according to me.

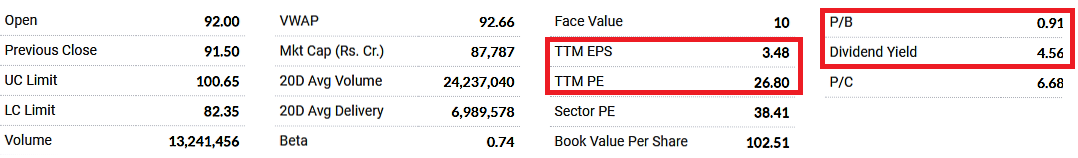

TTM PE is 26.87 while Industry PE is 38.41 so it is available at a discount. secondly, EPS were significantly affected due to corona virus in Q1 & Q2. There will be some what effect in Q3 results as well which are expected to be declared soon. IOC is the largest Airline Fuel supplier and this business is yet to be normalised. This is the reason for low EPS. However,demand for automobile fuel has increased significantly in last 3-4 months and New vehicles sales have already bettered itself from last year sales figures. Hence fuel consumption will continue to go for sure. However, this stock is still below its highest levels as shown in following chart.

Highest price was 235 of Sep,17 while it is way below currently at 93. This stock has excellent dividend payment record. Its current dividend yield is lowest in last few years at 4.53 %. Their average return are normally double than this. PB ratio is also 0.92 % which shows its current price is even lower than book price. Dividend paid in recent times in as follows.

Conclusion : Historical figures suggests that dividend yield of this company is much higher that Bank FD Rates. Its share price has already corrected a lot in last 2 years. So from here, it is showing good prospect of price improvement and healty dividend. Do your own research before you invest.

Thank you.

Jai Hind.

Links not part of this Blog

https://sharemarketwithgujjubhai.blogspot.com/2021/01/high-dividend-paying-stocks-in-india-rec.html

https://sharemarketwithgujjubhai.blogspot.com/2021/01/high-dividend-paying-stocks-in-india.html

https://sharemarketwithgujjubhai.blogspot.com/2021/01/high-dividend-paying-stocks-in-india-ioc.html

https://sharemarketwithgujjubhai.blogspot.com/2021/01/high-dividend-paying-stocks-in-india_5.html

https://sharemarketwithgujjubhai.blogspot.com/2021/01/list-of-highest-dividend-paying.html

dividend

indian oil corporation ltd

indiaoil

ioc

ioc dividend history

ioc result

iocl

Q1

Q2

Q3

Q4

sharemarketwithgujjubhai

- लिंक पाएं

- X

- ईमेल

- दूसरे ऐप

इस ब्लॉग से लोकप्रिय पोस्ट

5 Best Penny Stocks in India (4) 3i infotech

3i Infotech Ltd which was established as ICICI Infotech Ltd is an Indian IT company, started in 1993. 3i Infotech was promoted by ICICI Bank but ICICI divested the majority of the shares in March 2002. Since it was started by ICICI, Banking ,Insurance & Asset Managment are the core sectors where they provide their services. They provide ERP and other IT services as well. In 2005, company touched its peak price of 150 + but kept on reducing ever since then specially after 2008 worldwide recession. However, if you look at recent development, this stock is the real hot cake with stock prices daily touching its 5 % upper circuit as following. As shown above, just within a month this stock has been doubled and is increasing in one side upward direction. Even I am trying to grad this stock since last one week but not able to buy a single share. Reason: Why sudden hype over 3i infotech ? 3i Infotech has entered into definitive agreement...

5 Best Penny Stocks in India 2021 (2) Unitech

Hi Friends. I request you to please watch following video which was my first video on my youtube channel. This will largely explains you why I have ranked this penny stock in this list. https://www.youtube.com/watch?v=aWefTQH_tgc Once India's Largest Real Estate company, became victim of malpractices of its promoters. Thousands of home buyers who have paid money for their homes are still waiting for their possession. Than why this stock is featuring in this list if past is so tainted. Well, now this company is very much on recovery path as explained in the video. Chandra family is no more in the business and government nominated board is already doing it's job. They will complete Pending projects gradually and later this company may be bought by larger players. Mr. Niranjan Hiranandani is already on the Board !! Landbank which is possessed by Unitech is enormous & makes it lucrative & hence it is featuring in my list. No point is compar...

High Dividend Paying Stocks in India - PART 1

Who likes to have lucrative dividend income in bank account ? well all of us like the dividend income. How many companies in your portfolio give regular dividend? Very few ??? If so, don't you think it's time to correct your portfolio. Advantages of of regular dividend paying companies are as following. (1) Good companies pay dividend in the range of of 1 % to 15% on annual basis. Now this is a huge amount. Most of the mutual funds are giving approximately 10% return on annual basis. If if your company is giving even 10% dividend, it's a huge bonus since appreciation of stock value is entirely different. (2) regular dividend itself is a proof of good business management. Without continuous profit, continuous dividend is not possible. This itself is a proof that you are invested in the right company. (3) most of the high paying dividend companies are owned by government & hence there is always a sense of security. (4) sometimes market remains depressed for months or eve...

टिप्पणियाँ

एक टिप्पणी भेजें